Analyzing the Mat-Su Borough’s use of Transient Accommodation Tax Revenue and the Mat-Su Convention & Visitor Bureau’s proposed budget for FY2021

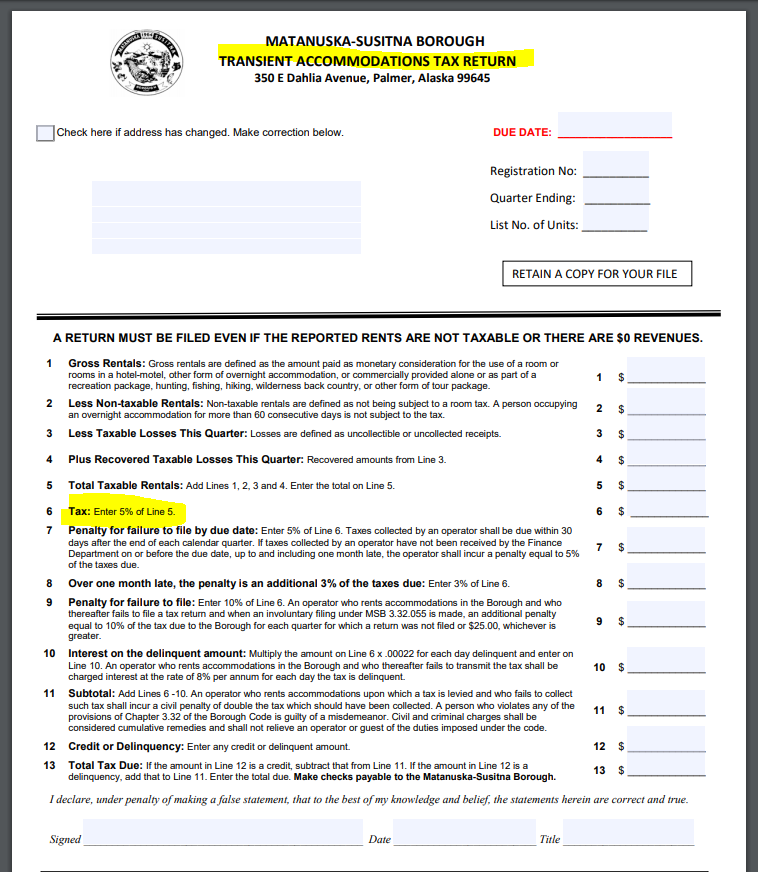

The Mat-Su Borough has been collecting “Transient Accommodation Taxes” (i.e. a “bed tax” or “lodging tax”) since the 1980’s. The current rate is 5%. This revenue is shared by the Mat-Su Borough Government and the Mat-Su Convention & Visitor’s Bureau, a non profit entity that promotes tourism in our area. The current split is approximately MSB 35% and MSCVB 65%.

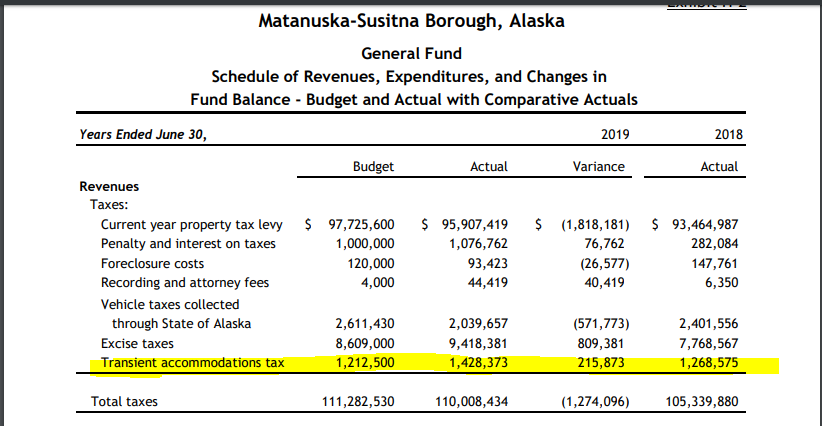

The Mat-Su Borough collected $1.428 million in Transient Accommodation taxes in FY2019 according to the latest CAFR on the MSB website. This was $215,000 more than expected. The MSB had estimated $1.212 million in bed tax revenue in their budget.

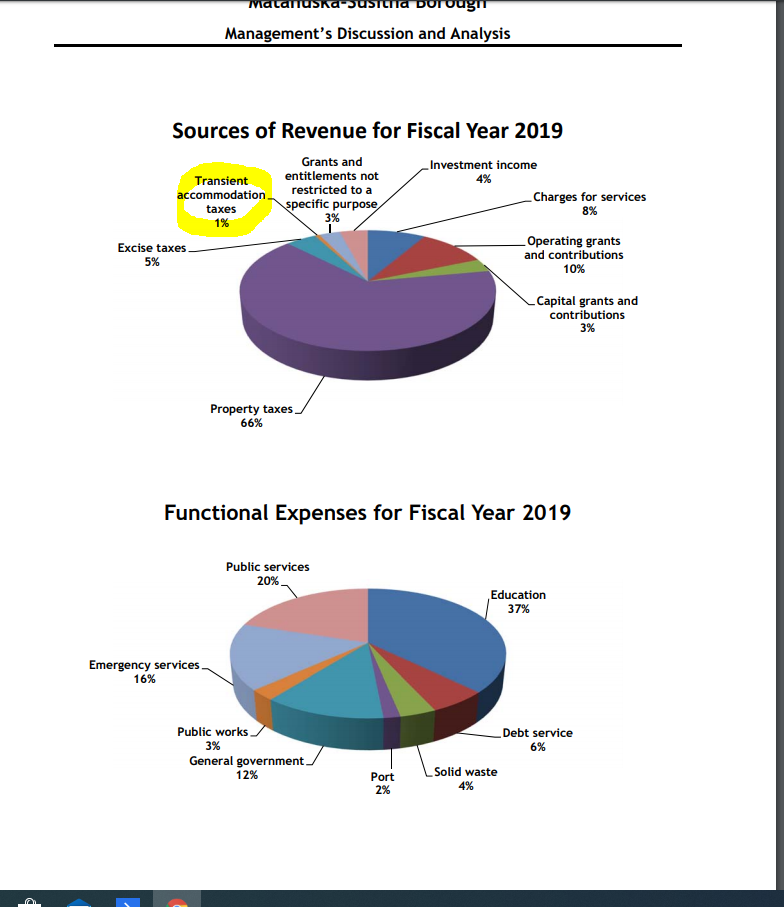

However, the bed tax makes up only 1% of the Mat-Su Borough’s total revenue. Note: It is unclear if the below chart from the CAFR is counting the full bed tax revenue or only the MSB’s 35% share of it.

Side Note: How does the MSB monitor and enforce the payment of these taxes? It all seems to be an “honor” system. Businesses are required to register with the MSB and submit tax “returns” and payments quarterly.

Approximately 50 cities and boroughs in the State of Alaska collect transient accommodation taxes. The rates range from 4 % to 12 %. How other government entities use these taxes varies. For example, Anchorage collects a fairly hefty tax of 12%. One third goes to the Muni’s general operating fund. One third is used to service the bond debt and operational costs of the Anchorage Convention Centers. The final one third supports the marketing efforts of “Visit Anchorage.”

The Mat-Su Borough doesn’t have a convention center. And we no longer have a Visitor’s Center ever since the MSB sold the land out from under the Veteran’s Wall and Visitor Center. Now the Mat-Su Regional Hospital owns the land.

https://matsumuckraker.com/2018/03/05/the-gateway-visitor-center-and-other-unfinished-projects/

https://matsumuckraker.com/2019/02/02/the-veterans-wall-lot-real-estate-sale-questions/

The MSB puts the bed tax revenue into the general gov’t operating fund and the MSCVB spends its share on tourism marketing – primarily via staff salaries and their website which is AlaskaVisit.com. Note: YahooMatsu.com redirects to AlaskaVisit.com.

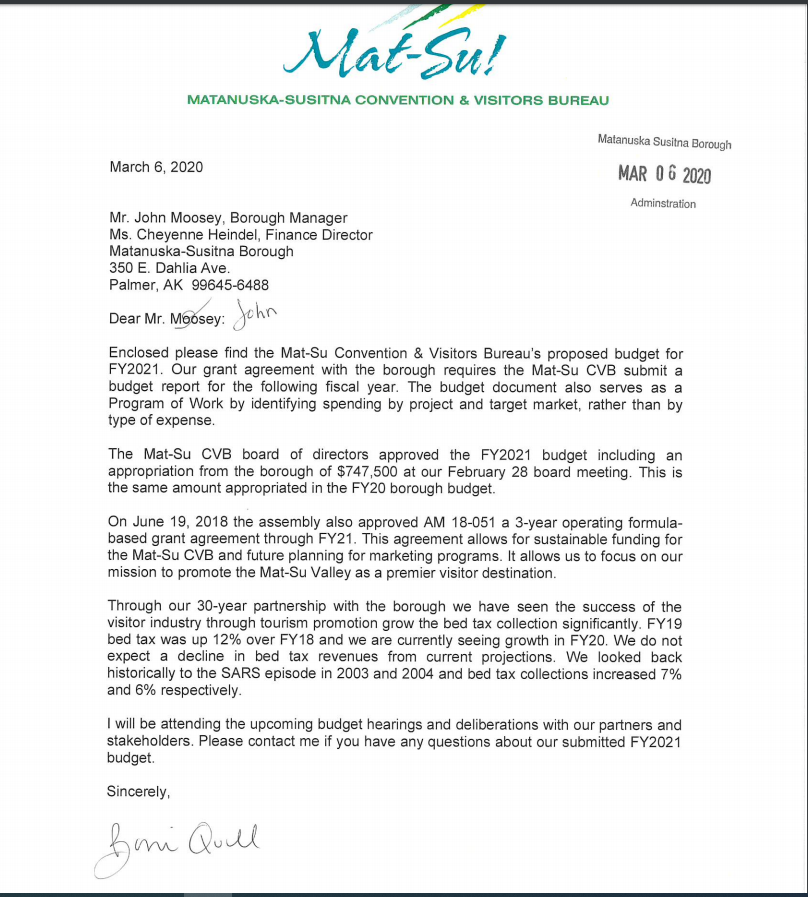

In the Manager’s most recent report to the Assembly members dated March 10th, but posted on the MSB website on March 17th (yesterday), the MSCVB’s proposed budget for next year is included.

NOTE: The MSCVB’s budget breakdown never used to be publicly available. The MSCVB posts a very general “financial statement” on their website but the detailed budget was never available to the public. Eugene Haberman is the one who pointed this out to me a while ago. However, now that the Manager is releasing his (previously confidential) memos to the public, we are getting more information.

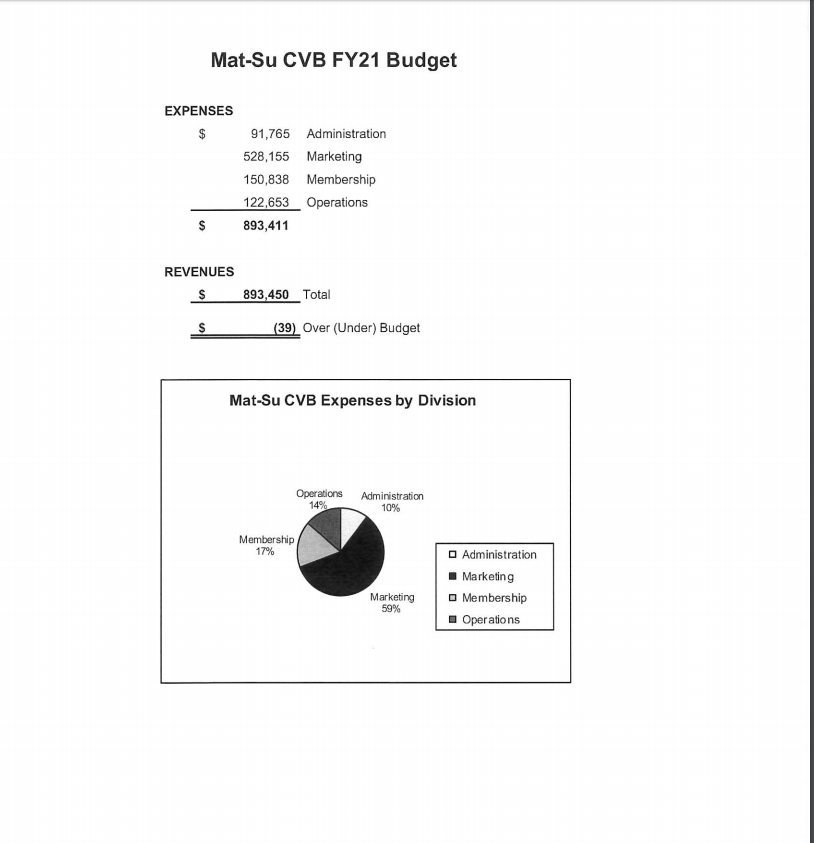

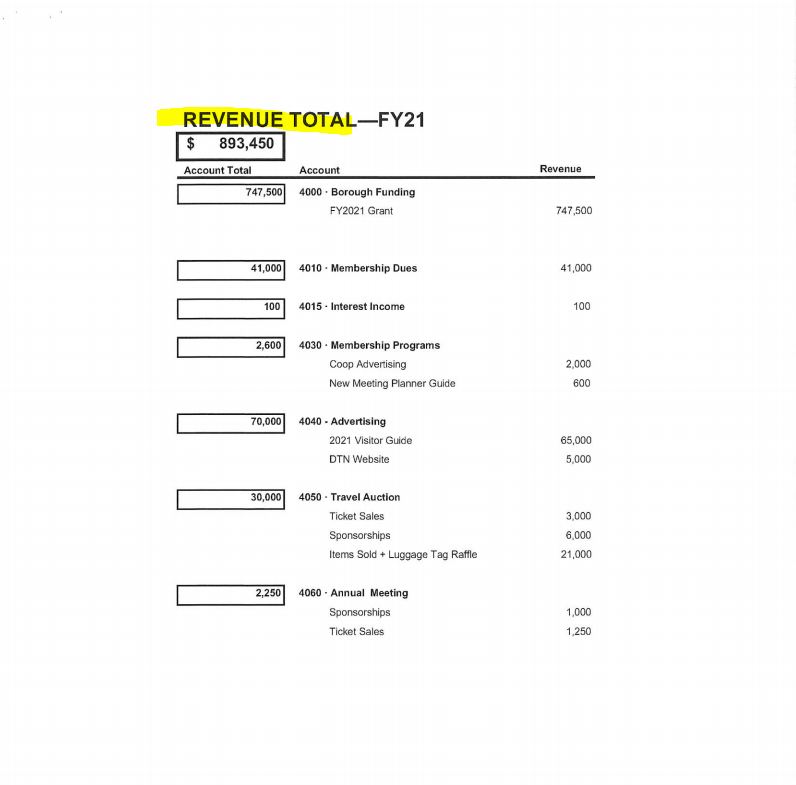

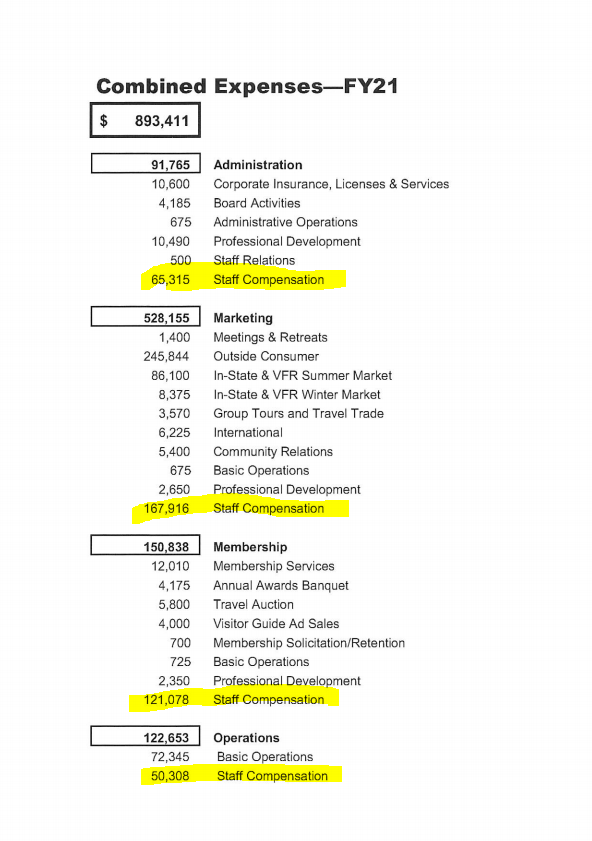

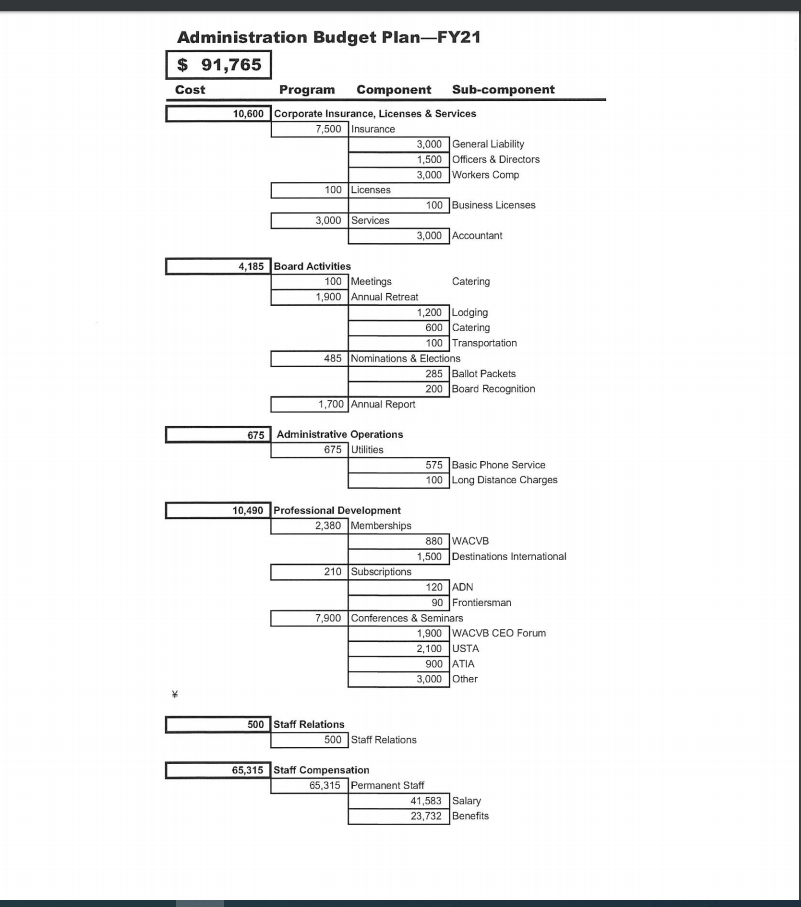

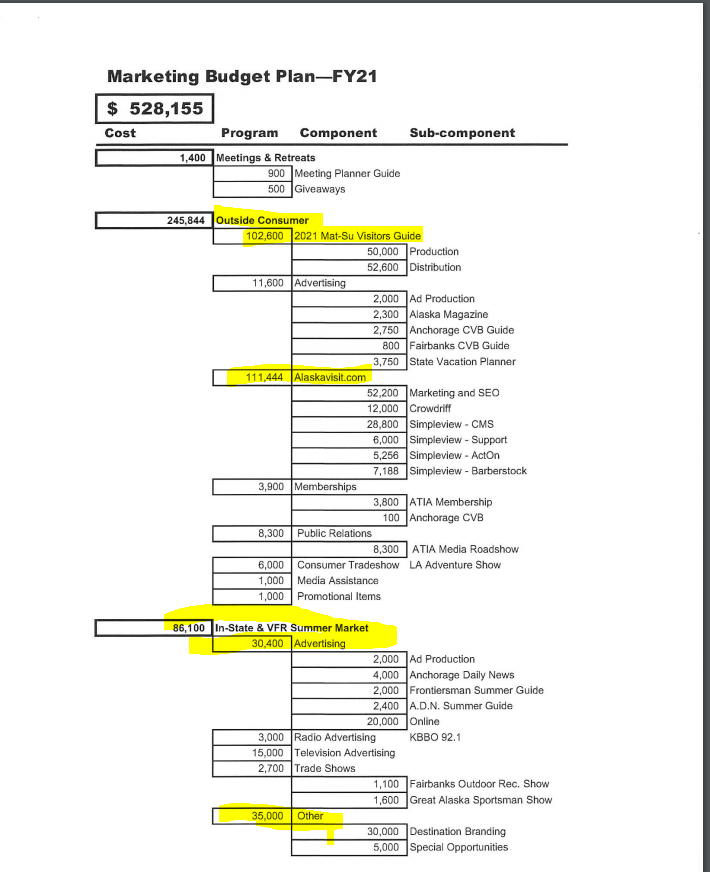

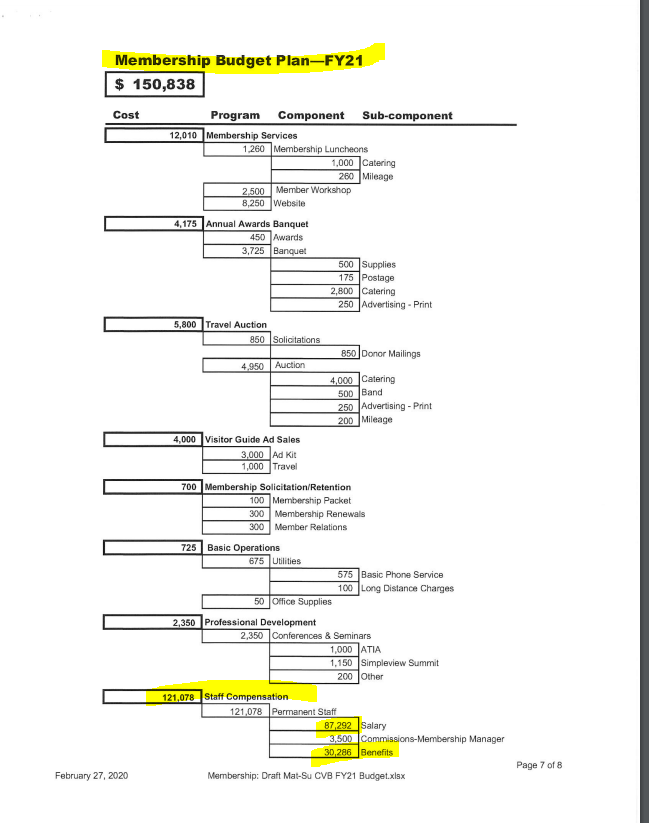

Here is the MSCVB’s proposed budget for FY2021:

QUESTIONS:

Is the MSCVB spending their share of the bed tax revenue wisely?

Do they need so many employees?

Do the MSCVB’s marketing efforts contribute significantly towards tourism in the Mat-Su?

Should the MSB split the bed tax revenue evenly – 50 -50 – instead of giving the MSCVB 65% of it?

Should the MSB dedicate its portion of the bed tax revenue for a specific purpose – say trails & parks – instead of putting it all in the general operating fund?