Here is a Cabbage Soup of leftover issues that were not covered in Parts One, Two or Three of this series. Big Cabbage Radio LOVES political BOOKS – but only liberal ones: Here are some books discussed and promoted on Big Cabbage Radio over the last few years. Do you…

MatsuMuckraker.com

Radio Free Palmer, also known as Big Cabbage Radio, as shown in Parts One and Two of this series, was founded by and is run by (with rare exceptions) people who have strong ties to liberal and progressive politics and causes. There is a dearth of conservative voices and viewpoints…

Radio Free Palmer’s slogan is: “We build, inform and celebrate community through local radio.” Most community radio stations have liberal roots and Radio Free Palmer is no exception. The people associated with Big Cabbage Radio are a veritable who’s who of leftist, progressive, and Democratic politics and causes in the…

OVERVIEW Big Cabbage Radio, the Mat-Su Valley’s “community radio station,” pushes a leftish agenda and its favored political causes and politicians in subtle and not-so-subtle ways. Radio Free Palmer is the formal name of the non-profit group that owns and operates Big Cabbage Radio. The station’s call letters are KVRF…

The MSB Assembly will interview their five finalists for the Manager position next week on Wednesday, October 21st beginning at 9 a.m. The five finalists chosen by the Assembly to interview are: Janette Bower, Michael Brown, Thomas Hutka, Travis Mortimer, and Randy Robertson. See more on their qualifications below. Note:…

The Mat-Su Borough Fall 2020 election will take place on November 3, 2020. Early voting is already underway. The following offices are to be filled at the election: Assembly District 4 (Wasilla; seat currently held by Ted Leonard who has opted not to run for a second term); Assembly District…

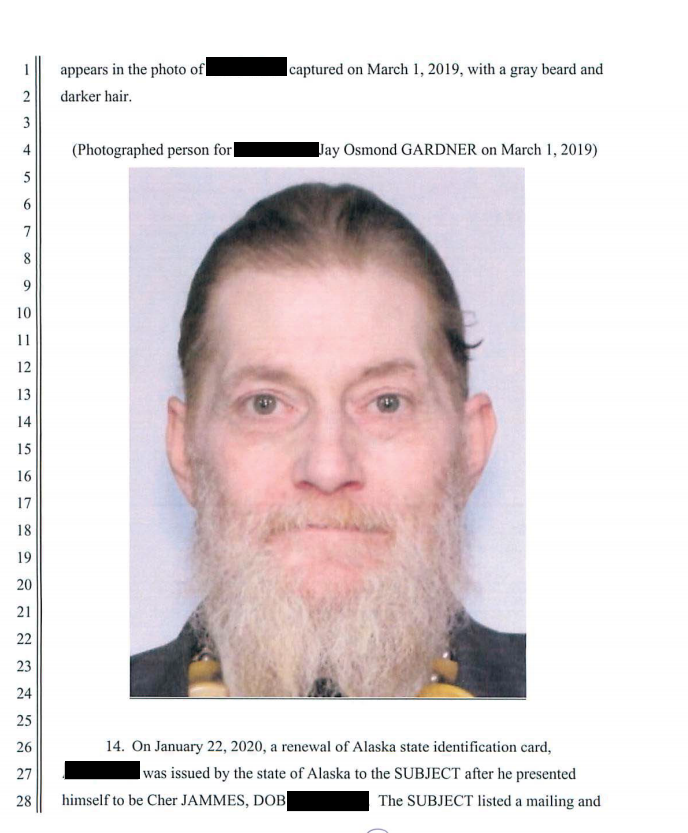

Jay Osmond Gardner was charged and arrested for Daniel Buckwalter’s murder over the summer. Mr. Buckwalter was the 46 year old Big Lake resident who was reported missing in August of 2015. A Palmer Grand Jury, on June 30, 2020, indicted Mr. Gardner for Murder in the First Degree, Murder…

Juan Camarena, who was named by law enforcement last fall as a “person of interest” in a Wasilla triple homicide investigation, plans to plead guilty in federal court to one count of unlawfully possessing ammunition (Felon in Possession). His Change of Plea is expected to take place during the week…

The United States Attorney’s Office for the District of Alaska issued a press release yesterday announcing that they have arrested and charged six people with running a criminal enterprise involving narcotics distribution, money laundering, and gun violence in furtherance of drug trafficking crimes. According to the indictment, the group was…

Faunus Doney, also known as Faunus Arden, who ran for Mat-Su Borough Assembly in the fall of 2019 before dropping out of the race, has reached a plea agreement with the United States Attorney’s Office in Anchorage in a wire fraud case. The terms of the plea agreement are as…