This item – NPI Update – was in the MSB manager’s notes to the Assembly dated June 9th, 2020:

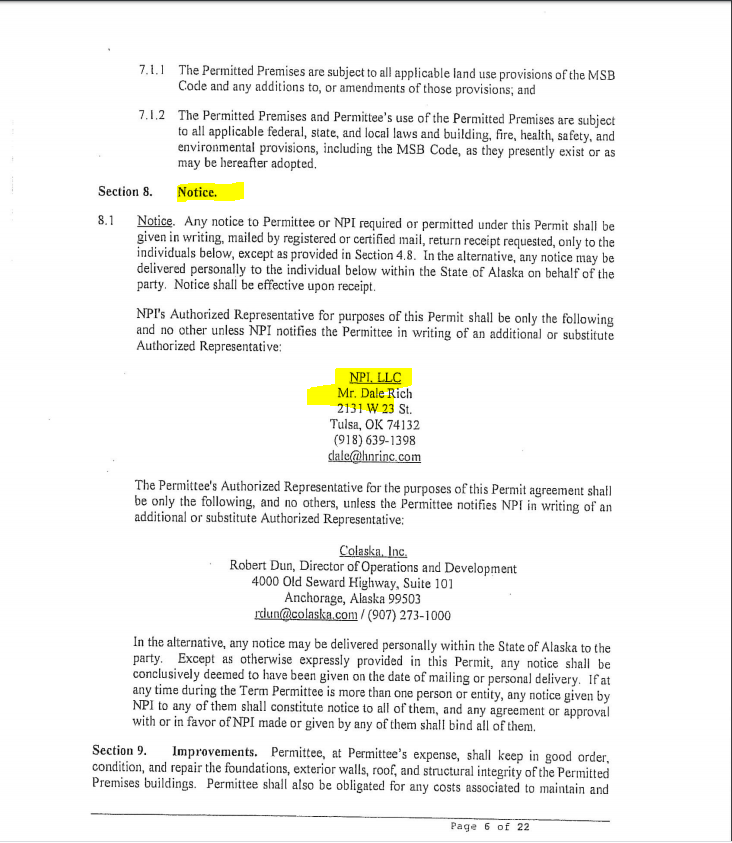

The MSB Manager announced in his report (which was only released to the public late last week), that NPI, which has two long term leases at the PORT, has sublet a portion of its leased acreage plus its warehouse to Coalaska for $4500 per month x three years. ($4500 per month equals $54,000 per year or $162,000 total over the three years.)

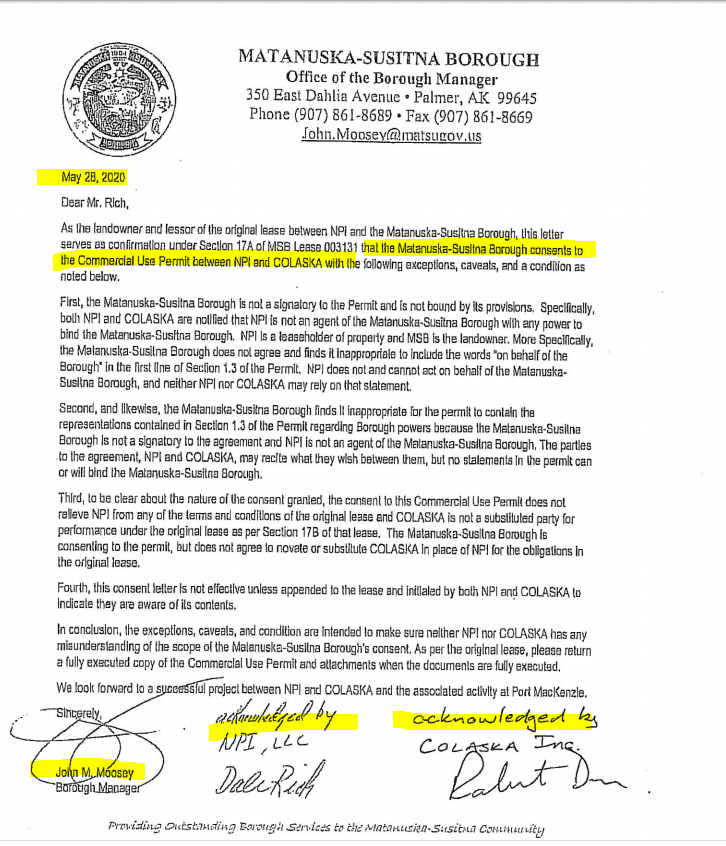

The agreement between NPI and Colaska, which is termed a “Commercial Use Permit,” was APPROVED by the MSB. (More on NPI and Colaska’s agreement/sublease/use permit later in this post.)

Here is the letter from the MSB approving the deal:

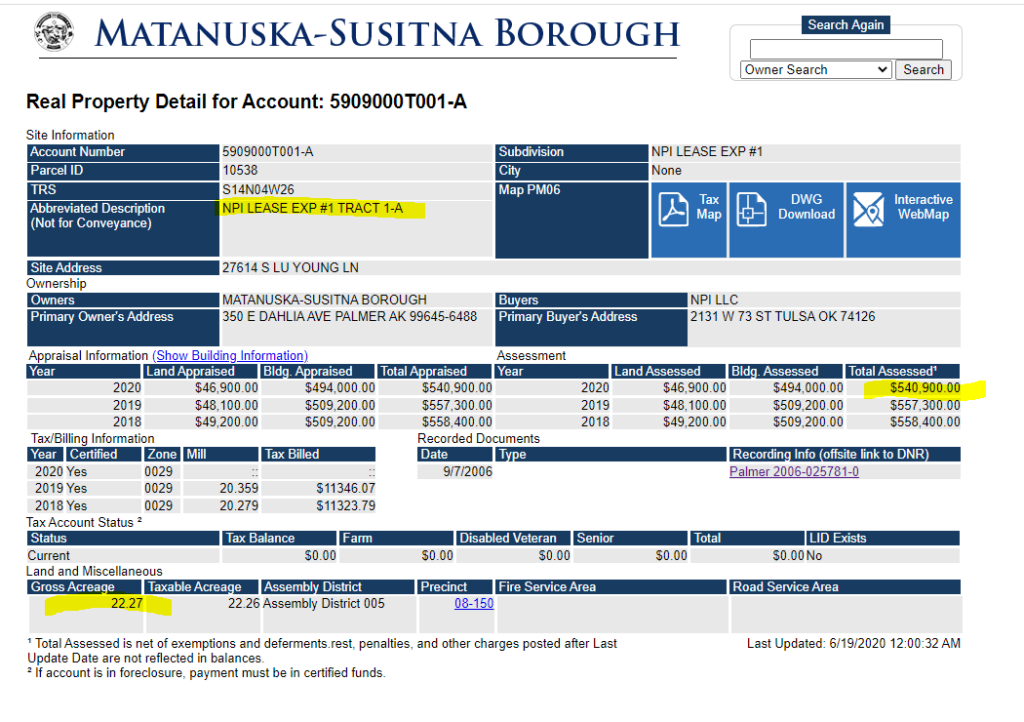

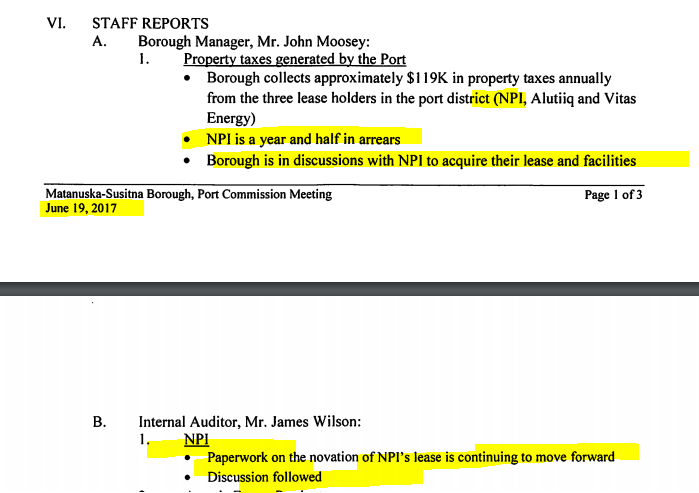

Why is NPI being allowed to sublet to and collect money from Colaska when it owes the MSB $451,677.51 in past due property taxes?

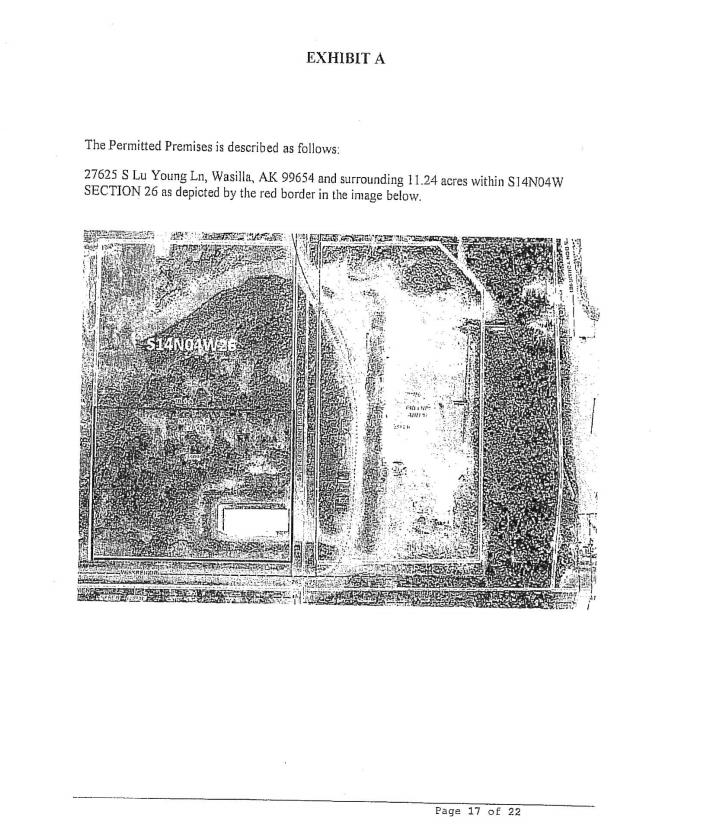

These are the two parcels of MSB land at the Port that are leased out to NPI.

The MSB Manager also gave a very vague update about the status of NPI’s twin leases in his new report:

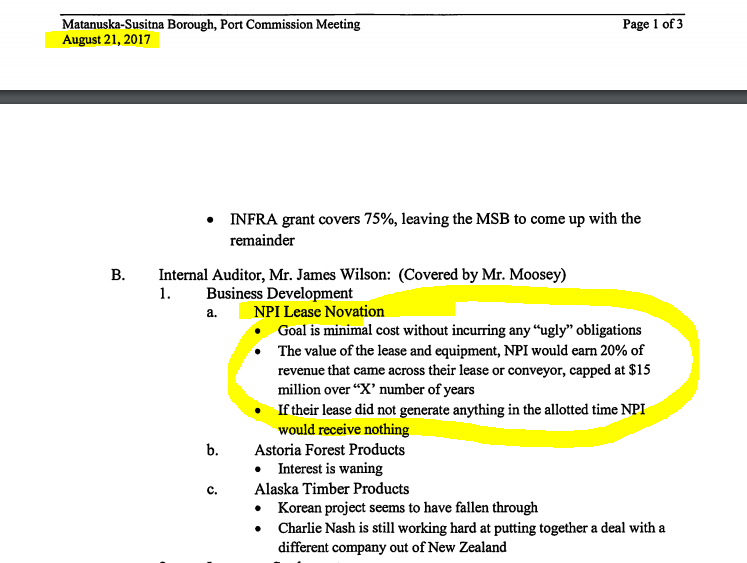

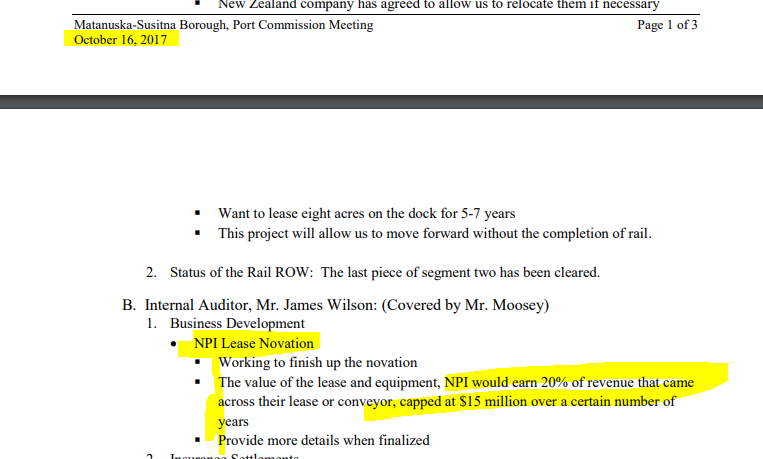

“Dale Rich, the owner of NPI, with a long-term lease at Port MacKenzie, has proposed to exit the marine business by turning over all improvements to MSB in exchange for a revenue sharing arrangement that includes a specific end date. The details have not been finalized with Borough staff.”

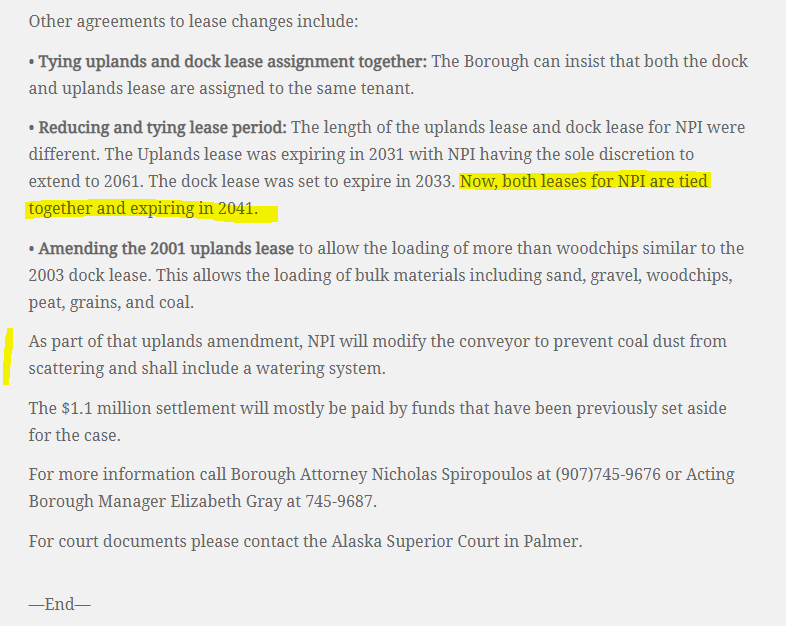

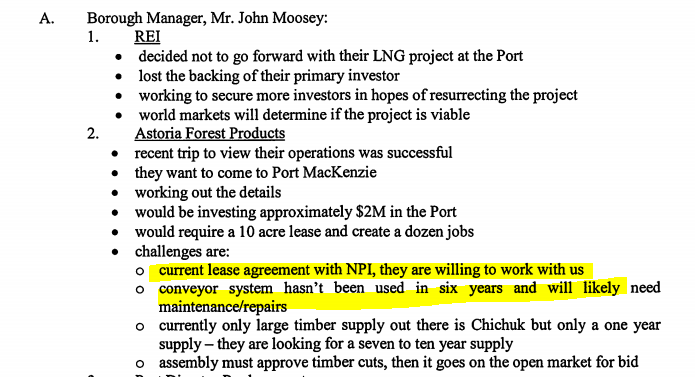

Of course no details have been finalized! The MSB has been trying to oust NPI from its leases (which do not expire until 2041) for YEARS with zero success.

Why did the MSB approve the Colaska sublease without working out an overall agreement with NPI re: terminating the leases? Why isn’t the MSB collecting the payments from Colaska directly to make up for the past due property taxes?

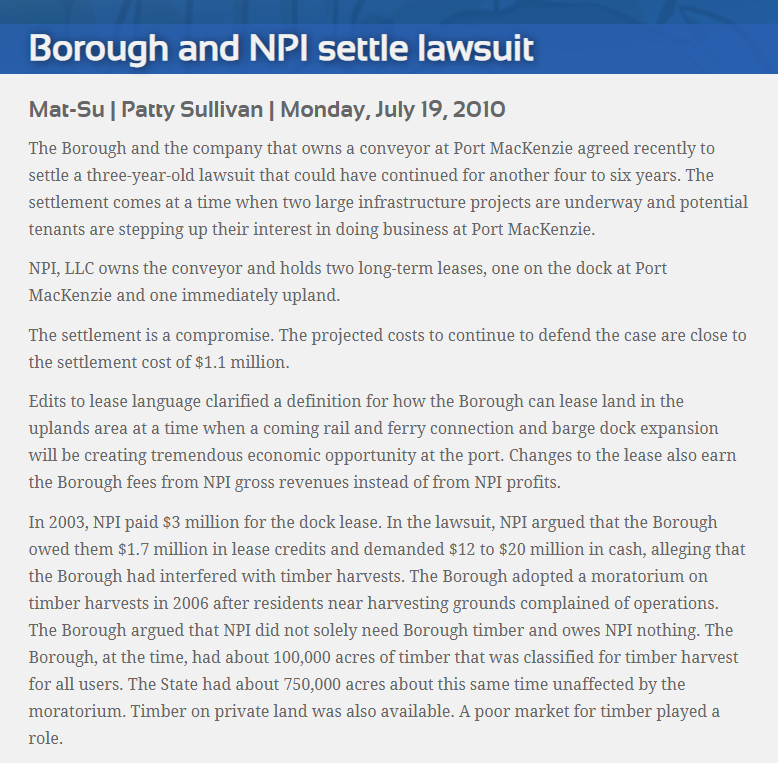

Background Info: NPI, LLC, a natural resources/timber company controlled by Dale Rich and his wife Debra Rich of Tulsa, Oklahoma, was the original “anchor tenant” at Port MacKenzie.

The MSB made its first deal to lease land to NPI in 2001. The second parcel was leased to NPI in 2006. NPI partnered with the MSB to build the $13 million dollar deep draft dock and conveyor belt system out at the Port. (Note: the deep draft dock is different than the regular barge dock. The conveyor belt system – at least the top part of it leading down from the uplands – is in disrepair.) NPI planned to ship timber and wood chips out of Port Mac to buyers in Asia.

However, NPI’s plans and the MSB and NPI’s relationship soured later in 2006 when the MSB Assembly voted to approve a moratorium on timber harvesting in the borough. NPI sued the MSB in Palmer Superior Court in 2007. The case dragged on for years (with expensive contract attorneys) and was finally settled in 2010.

The terms of the settlement seem to favor NPI. Also, NPI hasn’t paid the MSB anything at all since it abandoned its operations at the Port long ago.

The MSB – specifically our “Internal Auditor” James Wilson – has been trying get the MSB out from under the NPI leases for years with no luck at all. Wilson has traveled to Oklahoma to meet with the Riches several times and he keeps updating the Port Commission that “a deal is close.” Wilson has been saying this at the Port Commission meetings for years now.

The whole NPI lease is so extremely convoluted and involved with the lawsuit because after the lease the Assembly put a moratorium on logging. There is a large “credit” to NPI against the lease because they won the lawsuit. But …. there are many ways this could be turned into a better deal for borough residents.

After looking at the Myproperty page I had other questions about the taxes owed. The property is 17 acres in Point Mackenzie It has very little on the property looking at the satellite view. it has an appraisal of over 3 million it pays no RSA or FSA. However is taxed @ 20mill I thought the MSB was Limited at 10.5mill that is a little Fishy if you ask me.